Buy! Sell!

Moving on from the dystopia of last week’s newsletter, we’re back focused on building for our future financial strength — which given the unknowns around jobs seems a good idea!

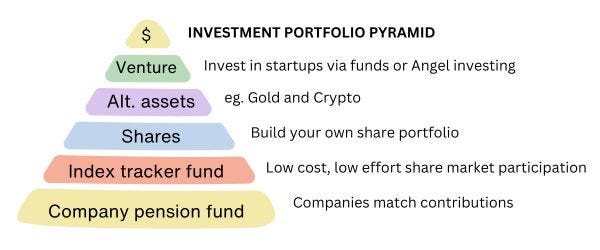

Remember my pyramid from a few weeks ago ? This week we’re half way up it, looking at building your share portfolio.

⚡ Quick Hits

- Market Engagement: Having direct stock ownership helps you spot future trends.

- Share market fundamentals: Dividends, Growth, Earnings calls, P/E….lets decode the language.

- Buffett's Magic: Warren Buffett's value investing approach centres on finding undervalued companies with strong fundamentals.

- Magnificent Margins: The "Magnificent Seven" tech giants continue to dominate the US market despite recent volatility.

- Quote: "Your ego is writing cheques your body can't cash" - Yes I’ve made a Top Gun line apply to an investor metric!

🌐 Why Invest in the Stock Market?

I believe that having a selection of individual stocks in your portfolio brings benefits beyond potential financial returns. The primary advantage is engagement – it keeps you connected to the markets in a way that passive index investing does not.

When you own individual companies, you naturally pay more attention to quarterly earnings reports, industry trends, and competitive dynamics. You start noticing products and services in your daily life that might represent investment opportunities which you can jump on before they are obvious to everyone.

Take Nvidia as a perfect example. An investor who was tracking developments in artificial intelligence and recognized the importance of specialized chips would have had the opportunity for life-changing returns. From 2013 to the present, Nvidia stock has delivered a return of over 46,000%. That means a $1,000 investment in 2013 would be worth approximately $460,000 today. This kind of return doesn’t happen often, and perhaps easy to see in hindsight, but I’d suggest the knowledge needed for an Nvidia bet is far less than we might think. It’s about spending small but consistent amounts of time paying attention.

My personal bias is to include tech stocks because following them makes us more aware of the technological trends that increasingly underpin all aspects of our lives. Understanding Meta's social media dominance, Apple's current failure to deliver an AI strategy, or Microsoft's cloud computing success gives us insights not just as investors, but as participants in a rapidly evolving digital world.

Even if you're primarily an index investor (which is a perfectly sound approach), having a small portion of your portfolio in selected individual companies keeps you more engaged and informed. This increased market awareness can improve your overall investment decisions, helping you stay the course during downturns and potentially identifying opportunities that others miss.

With platforms like Sharesies making it so easy to fractionally invest you can easily have a diversified small portfolio to get started — there is no need to bet the bank.

🎯 Dividends vs Growth: Different Paths to Profit

When investing in stocks, you'll encounter two broad approaches to generating returns: dividend investing and growth investing.

Dividend-Focused Companies Dividend stocks distribute a portion of their profits directly to shareholders, typically on a quarterly basis. These companies are often mature, established businesses with predictable cash flows such as:

- Johnson & Johnson (healthcare)

- Coca-Cola (consumer goods)

- BP and Shell (energy)

- Major banks like HSBC and Barclays

Microsoft and Apple also pay dividends now, though at relatively modest yields (approximately 0.8% and 0.5% respectively), as they balance shareholder returns with continued investment in growth.

Growth-Focused Companies Growth stocks prioritise reinvesting profits back into the business to expand operations, develop new products, or enter new markets. The classic example is Amazon, which has never paid a dividend.

Growth investors aim to profit from share price appreciation rather than regular income. While this approach offers potentially higher returns, it typically comes with greater volatility and risk. If we compare it to property, it’s the difference between buying a house for it’s rental income, vs hoping for Capital Gain.

For investors, the choice between growth and dividend stocks often comes down to personal circumstances. Those needing regular income (such as retirees) may prefer dividend-payers, while those with longer time horizons might accept higher risk for greater growth potential.

💰 Understanding Investment Metrics and Earnings Calls

Successful investors need tools to evaluate whether a stock might be a good buy, (or one of Warren Buffets ‘bargains’ below). Here are some key metrics that can help guide your decisions:

P/E Ratio (Price-to-Earnings) The P/E ratio is perhaps the most widely used valuation metric, calculated by dividing a company's current share price by its earnings per share (EPS).

This ratio reminds me of that classic line from Top Gun: "Your ego is writing cheques your body can't cash." Companies with sky-high P/E ratios are essentially promising future growth that may prove impossible to deliver. The market is betting these companies can "cash the cheque" of their current valuation with future earnings!

For example:

- The average for the S&P 500 is around 27

- Nvidia currently has a P/E ratio of around 39-40

- Meta (Facebook) has a P/E ratio of approximately 23

It's worth noting that Nvidia's P/E ratio has actually decreased from its 2023 levels when it was above 65, and significantly lower than its 3-year average of around 78. This suggests that while investors still expect strong growth, expectations have become “somewhat” more realistic.

Earnings Calls - You might hear on the news that a company had their ‘Quarterly earnings reports’ or ‘Earnings calls’ (which is when they talk to analysts after they’ve publicly announced results). These are the times when companies reveal whether they've delivered on promised growth and provide guidance for future quarters. These updates are what underpins confidence in the P/E ratio.

The current market climate has created a somewhat unrealistic expectation that companies should not just meet analyst expectations but exceed them. What we sometimes see now — particularly in tech stocks — is companies that merely meet expectations (which should give investors confidence) can see their stocks dip. This is an example where you want to look at the business metrics to get your own thoughts on performance, not just react to what the share price is doing - institutional money works on different rules to you.

Earnings calls can provide invaluable insights beyond the raw numbers. Listening to these calls (or reading the transcripts) is an excellent way to deepen your understanding of businesses you own or are considering.

Other Important Metrics

P/B Ratio (Price-to-Book): Compares a company's market value to its book value (assets minus liabilities). A lower P/B might indicate an undervalued stock.

Debt-to-Equity Ratio: Measures a company's financial leverage. Higher ratios suggest more risk.

ROE (Return on Equity): Shows how efficiently a company generates profits from shareholders' equity. Higher is generally better.

Dividend Yield: Annual dividend payments divided by share price, expressed as a percentage. Shows the income return on an investment.

PEG Ratio (Price/Earnings-to-Growth): P/E ratio divided by earnings growth rate. A PEG under 1.0 may indicate an undervalued stock relative to its growth prospects.

Finding these metrics is easier than ever for amateur investors. Most financial websites and investing apps display them prominently on stock summary pages. Free resources like Yahoo Finance, Google Finance, and many brokerage platforms provide these figures, making fundamental analysis accessible to everyone.

🧠 Warren Buffett's Investment Philosophy

Warren Buffett who has just stood down as CEO of Berkshire Hathaway age 94, has built his fortune through a disciplined value investing approach that centres on finding companies with strong fundamentals trading below their intrinsic value - essentially looking for bargains in the market.

Everyone can develop their own investment strategies, but the key principles which Warren Buffett used are:

Circle of Competence: Invest in what you understand. This meant Buffet largely avoided Tech investments, his notable exception being Apple, which it is worth noting, makes up almost 30% of Berkshire Hathaway’s total value (so maybe tech is worth a look). Note: Don’t write anything off because you do not currently understand it. Now we have AI you are able to understand a lot more with less time than ever before.

Economic Moats: Buffett seeks companies with sustainable competitive advantages that protect them from competitors. These "moats" can come from distribution power (Coca-Cola), network effects (American Express), or regulatory advantages (railways). In an AI world, looking at ‘how can this not be replaced by an AI competitor’ will be and important moat.

Management Quality: He places tremendous importance on honest, capable management teams.

Long-term Horizon: Perhaps most importantly, Buffett views stocks as ownership in actual businesses rather than trading vehicles. His favourite holding period? "Forever."

Margin of Safety: Buffett insists on buying companies at prices well below their intrinsic value, providing a buffer against errors in analysis or unexpected events.

💡 The Magnificent Seven: Market Dominance

The term "Magnificent Seven" refers to the dominant tech giants that have driven much of the US stock market's growth in recent years: Apple, Microsoft, Alphabet (Google), Amazon, Meta (Facebook), Tesla, and Nvidia.

These companies have transformed our daily lives while creating enormous wealth for investors. Their dominance comes from various competitive advantages:

Network Effects: The more people use their services, the more valuable they become (think Meta's platforms)

Economies of Scale: Their massive size allows them to operate more efficiently than competitors

Control of Digital Platforms: They own the gatekeeping technology that other businesses must use (Apple's App Store, Google's search)

Data Advantages: Their vast troves of user data create barriers to entry for competitors

Currently, these seven companies make up over 30% of the S&P 500 index's total value, meaning their performance has an outsized impact on market indices and many people's investments. This concentration has raised concerns about market vulnerability - if these stocks falter simultaneously, the broader market suffers significantly.

Despite their dominance, these companies face mounting challenges, including regulatory scrutiny, competition, and the law of large numbers - it becomes increasingly difficult to maintain high growth rates as a company's size increases.

Even if you don’t invest in them, checking in weekly on developments with these giants I believe is a great way to ‘keep up’ with what is happening in our digital world.

👁️ Who I’m watching

Meta : As much as I dislike the hold Meta has on society at large — via Facebook, Whatsapp, Messenger and Instagram — this very scale combined with an excellent (if flawed IMO) CEO and very deep pockets makes them for me, had to overlook for further growth.

The company has unparalleled data on human connections, preferences, and behaviours across its platforms, and now has the additional ‘data collection agent’ Llama, its open-source, free AI model. This data moat gives them extraordinary advantages in targeted advertising and understanding social trends.

If you have not heard of Llama yet, you likely will in the coming months. It is worth understanding (before you happily hand over more data to Meta by using it) the difference between it and non-open source models like ChatGPT. Having less safety guard rails is one of the issues. Read my Perplexity query here.

Apple: Often thought of as a market leader, Apple has been outperformed over the last few years — so maybe it’s about to have a resurgence?

Headwinds:

- Late to the AI revolution compared to competitors like Google, Microsoft, and Samsung

- Declining iPhone sales, particularly in critical markets like China

- Recent legal setback with App Store practices, including a contempt ruling that could threaten services revenue

- Upcoming iOS features delayed, raising concerns about execution

- Is a phone even going to be the main device we all use in the future?

Tailwinds:

- Massive financial resources: $60+ billion in cash reserves and $100+ billion in annual free cash flow - could acquire its AI capability if it can not build it.

- Recently announced $500 billion investment plan for the US over the next four years

- Loyal customer base with high ecosystem lock-in and brand loyalty

- History of successfully entering markets late but with superior execution

Apple is also probably a bit of a GenX favourite, but don’t let that emotional connection get in the way of a good investment analysis!

🎧 Essential Listening

For anyone looking to understand market trends in an accessible, engaging format, I always recommend The Prof G Markets podcast. Scott Galloway and his co-host break down complex market dynamics into digestible insights, with a particular focus on tech companies and major market movers.

What makes this podcast especially valuable is how it provides a framework for analyzing stocks across all sectors. The discussions about valuation metrics, competitive positioning, and management quality can be applied to companies within your own circle of competence, even if they're outside the tech sector.

The show combines economic analysis with cultural context, helping listeners understand not just what is happening in the markets, but why it matters. It's become my weekly ritual for staying informed without getting lost in financial jargon or overly technical analysis.

Until next week, keep Looking up.

Sally H

Look Up is curated by Sally and Claude. Have feedback or suggestions? Drop a comment below.