Buy the haystack

Is IWD over yet?

As International Women's Day rolled around again this year, I found myself scrolling through countless social posts highlighting gender disparities. While raising awareness is important, I couldn't help but notice how posts focusing on solutions receive significantly less engagement than those simply identifying problems - which seems in itself a problem.

Similarly this time last year, I was at SXSW in Austin surrounded by brilliant women across industries. The energy was amazing, yet conversations still leaned heavily toward challenges rather than actionable solutions.

Change requires us to identify the big system levers we can pull on and from where I stand, one of the most powerful is money. Women controlling more capital isn't just about personal wealth — it's about shifting the entire power dynamic. That's why I'm passionate about these conversations, and believe we have to be committed to the long game on this - change ‘won’t happen overnight, but it will happen’. Lets go.

⚡ Quick Hits

- Market Uncertainty: Why market drops are opportunities, not dangers

- Investing 101: Why index tracker funds should be your first step into the stock market

- Set It & Forget It: The power of passive investing and how it outperforms active management

- Numbers Game: How a 1% management fee can cost you thousands over your investing lifetime

Quote: "Don't look for the needle in the haystack. Just buy the haystack”

John C. Bogle, founder of The Vanguard Group.

📉 Market Uncertainty: “Buy the dip”

With recent tariffs introduced by the US administration causing global uncertainty in financial markets and significant drops in the US stock market you might once again be thinking, “I’m so glad I don’t invest in the share market, it just goes down!”.

It's a natural concern, but keep in mind you are probably only aware of it when it goes down (going up is less newsworthy), and also history has consistently shown that markets move in cycles. What goes down has historically always gone back up, given enough time. The S&P 500, despite experiencing multiple severe crashes, has delivered average annual returns of about 10% over the long term.

When markets fall, you're essentially getting shares on sale. It might feel counterintuitive, but these moments of uncertainty often represent the best buying opportunities for long-term investors. And that’s us!

🔑 This Issue's Key Message: Start Simple

Many of us (especially if we are old enough to remember the movie Wall Street) think investing in the stock market requires expert knowledge, constant attention, or paying someone else to manage it all. While this may have been true when we had stockbrokers as gatekeepers to investing, now we all have access to the stock market via our smartphones. With the curtain being pulled back we can see it's not nearly as complex as previously advertised (hmm, I wonder who's interest it is to keep that way🤔 ).

Index tracker funds have become a popular choice for customers of app based share platforms due to their simple, passive and low cost way to get access to the market. These funds give you instant diversification across hundreds or thousands of companies, minimize costs, and — perhaps most surprisingly — consistently outperform professional fund managers over the long term. They are what we are going to dig into today.

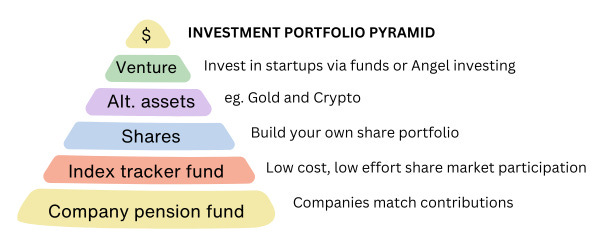

🔍 The Investment Pyramid: Building Your Wealth Strategically

Before diving deeper into Index funds, let's take a wider view of investing options and where I see Index funds fitting. I find it useful to break it into distinct layers and we will take a look at each one in turn over the coming weeks:

In theory, the percentage of your portfolio mirrors the size of each layer, as the ‘higher’ the level the higher the risk/return ratio. You choose how much you invest at each level based on your goals, time and risk tolerance.

For me personally, being late to investing in these areas, (and as I do not have an employer pension anymore), all my investments are in the top three. However, this will change this week as I will practice what I preach and choose an index tracker fund.

Remember, all these are long-term investments — we're not talking about day trading or timing market movements.

📈 Index Trackers: The Investor's Secret Weapon

What they are: Index trackers mirror a market index like the S&P 500, NZX 50, or a global stock index. When you buy in, you automatically own a tiny slice of every company in that index.

Why they work:

- Diversification: One purchase spreads your risk across hundreds of companies

- Low fees: Typically charge 0.03-0.25% annually (compared to 1-2% for actively managed funds.

- No guesswork: You're not trying to pick winners — you're owning the entire market (hence the above haystack quote)

The performance secret: Study after study shows that around 80-90% of professional fund managers fail to beat their benchmark index over a 10-year period. We're not talking about a small difference either — the gap can be substantial.

💸 The True Cost of Fees: A 1% Problem

A 1% difference in fees may not sound like much, but this simple scenario shows that due to the compounding effect, it can make a big difference to achieving your goals.

Imagine investing $10,000 with a 7% annual return over 30 years:

- In an index fund charging 0.1%: Your money grows to approximately $74,000

- In an actively managed fund charging 1.1%: Your money grows to about $54,000

That seemingly small 1% difference in fees costs you $20,000—nearly 30% of your potential wealth - and this assumes both funds performed equally, when research suggests the managed fund will underperform.

And remember, that's on just a $10,000 investment. Scale that up to your life savings, and we're talking about potentially hundreds of thousands in lost returns.

This isn't about being cheap—it's about understanding that every dollar in fees is a dollar that isn't compounding for your future.

To learn more about Index Tracker Funds I recommend jumping onto Claude or ChatGPT and ask them to act as an investment coach. Ask lots of questions about how Index funds differ to managed funds and other options. Having a ‘conversation’ about it will cement your learning and help you feel confident and equipped to take action. You can also ask them for platform options to use in your region to start investing.

🔍 Next Week: Investing as a Window to the World

While set-and-forget investing is powerful, having some skin in the game can also help you stay connected to broader economic trends.

Next issue, we'll explore how putting some money into specific companies and then following these investments, naturally increases your awareness of key sectors (such as Technology ) as well as global economic forces, and can provide great returns.

Have a great week. I’m off to an Angel Investing Pitch night which I look forward to reporting back on.