Serena at the Superbowl, Stablecoins and Spotify

Welcome to Issue 2 of Look Up - your weekly shortcut to tech, investing and culture so you can build a stronger future for yourself and the world. Thank you to all those who subscribed.

This week, I’ve been thinking a lot about investing—and specifically, GenX’s negative relation to it compared to all other age groups. I have a theory our childhood experience is one factor.

I think a lot of us Gen Xers grew up watching our parents dip their toes into the stock market, only to get burned by the 1987 stock market crash—still the worst crash in history. At the time, market dynamics, risk, or the idea of long-term investing would have not been familiar concepts to us, instead, what stuck with us was a much simpler, much louder message: NEVER INVEST IN THE STOCK MARKET!

I’ve had this conversation with friends my age, and they all agree—it left a lasting impression. For too long, the stock market has been synonymous with losing money, not building wealth. But we need to recognise this flawed thinking and move forward seeing it as a one way to build financial security.

The truth is it has never been easier to invest as we now have direct access to the share market via apps on our phone, no need to find a broker or an intermediary. (Financial management groups were also a ‘do not go there’ for GenXers here in NZ after several huge collapses in the 80s). Like most things, we just need to ‘make a start’.

An idea I had to assist this was to bring back some of the 80s optimism (minus the shoulderpads) and make Investing clubs the new book clubs. Get together with a group of friends and share ideas, thoughts, research and support each other to take action. As the saying goes:

The best time to invest was yesterday, the next best time is now.

⚡First the headlines

🚕 Self-driving taxis expand across the USA - but it might not be the name behind it you expect.

☕ Can Starbucks make a comeback with their new CEO and wholesale changes to the coffee chain?

🏈 Polymarket a new decentralised, transparent way to gamble has transactions of $1.1bn on the SuperBowl.

🚗 Mevo car share comes to my home town.

🎙️ Learn about Angel Investing from Playmoney founder Cheryll Kellond and how you likely know more than you think about what makes a good investment.

💾 Tech News

🚕 Self driving taxis

When it comes to self-driving cars, most people think of Tesla—and their ongoing struggle to bring fully autonomous vehicles to market. But there’s another player that’s been quietly making strides: Waymo, the self-driving taxi company owned by Alphabet (Google’s parent company).

Waymo has been operating since 2020, and at the end of 2024 took a step forward by partnering with Uber. This collaboration is a game-changer because it allows Waymo to scale its services to new cities much faster. Until now, Waymo’s self-driving taxis were only available in Los Angeles and San Francisco. But thanks to this partnership, Austin and Atlanta will be the first new cities to get access to the service. Uber just announced the waitlist for account holders.

It’s an exciting development, not just for Waymo but for the future of autonomous vehicles in general. Waymo’s approach—focused on ride-hailing rather than consumer-owned vehicles—might just be the smarter path to bringing self-driving tech into the mainstream.

💸 Fintech

When it comes to blockchain and crypto, stablecoins are one of the most practical and impactful use cases we have right now. As the name suggests, stablecoins are designed to be, well, stable—unlike the speculative cryptocurrencies like Bitcoin or Ethereum, which are more often talked about. Pegged to stable assets like the US dollar, they offer the best of both worlds: the speed and efficiency of blockchain technology without the volatility.

One of the biggest advantages of stablecoins is international payments. Sending stablecoins across the globe costs just a fraction of what it takes to transfer traditional fiat currency (government-issued money like dollars or euros). This makes them a game-changer, especially in regions where banking systems are slow or expensive—or for international workers who send their hard-earned income back to families in poorer countries. Right now, many of these workers rely on services like Western Union, which charge hefty fees (Tonga’s third biggest contributor to its GDP is Western Union fees 🤯). Stablecoins offer a faster, cheaper, and intermediary free alternative.

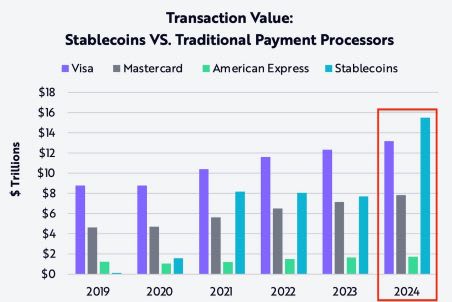

2024 was a major milestone for this innovation: for the first time, the total transaction value of global payments using stablecoins has surpassed that of traditional payment giants like Visa and Mastercard. That’s a huge deal—it shows how blockchain-based currencies are starting to disrupt the way we move money around the world.

Regions like Latin America and Sub-Saharan Africa are particularly embracing stablecoins as a hedge against local monetary instability.

While crypto often gets a bad rap for its speculative nature, stablecoins are proving blockchain technology has real, tangible value and not just to a few people collecting the value at the ‘top of the food chain’. To learn more about them and how they work this is a good overview. Chainanalysis

📈 AI spend

Despite our new friend from last week Deep Seek showing potential for a (much) cheaper way to build AI, all the tech giants planned spend on AI remains unchanged and collectively totals over $300bn in 2025, up from $230bn in 2024.

💰 Money Talk

Lots of earnings reports out over the last few weeks. Here are three insights from household brands we all know.

☕ Starbucks: Brian Niccol, the former CEO of Chipotle, recently stepped into the role of Starbucks CEO with a compensation package that might make you mutter, “This is why people hate capitalism.” But if he can work the same magic he did at Chipotle—where he drove their share price up by 900%—shareholders will feel it’s justified. Their latest earnings report showed shoots of improvement over the last quarter, but how quickly they can successfully execute the changes they’ve signaled will be the measure of success.

As an aside if you are a fan of Starbucks and customer experience then this is an amazing listen with the founder, Howard Schultz.

📱 Meta: A brand that seems to defy traditional marketing—users often dislike (hate even) the company but we remain hooked on its products (Facebook, Instagram, and WhatsApp). It has a huge amount of tailwinds going into 2025 and the stock market has reacted accordingly pushing it to an all time high share price:

- At the end of January, Meta released its annual earnings, showing growth across nearly every metric.

- They’re considering reincorporating from Delaware to Texas, which is seen as having a more favorable legal and regulatory environment.

- As of Monday 10th Feb, they’ve started laying off about 5% of their workforce.

It’s hard to imagine anyone competing with Meta. Their success is built on user addiction, cutting-edge technology, powerful network effects, and what amounts to a near-monopoly on social media—two-thirds of global social media usage happens on a Meta platform.

📻 Spotify has had their first profitable year in 16 years of trading. They have added users despite putting up prices, and their subscriber numbers are impressive averaging out to 1 in 12 people on the planet!

You can easily find forecast price recommendations for these or other stocks online which will include the reasons behind their projection. All useful to build the muscle of keeping up with markets. It is less effort than you likely think.

😎 Culture Corner

The Super Bowl has come and gone (and just FYI, Taylor Swift’s boyfriend’s team, the Chiefs, lost to the Eagles). But the Super Bowl is so much more than the on field result. The off-field action, the ads, the halftime show, and the booming world of sports betting is where the money flows and the cultural conversations happen.

🎤 Half-time show: Pulitzer Prize winner Kendrick Lamar’s performance was layered in symbolism which I loved (after the internet explained it all to me). Worth going down the rabbit hole if you like the story behind the art. The Serena Williams cameo was 💥.

👀 Ads: With around 127million views the Superbowl is one of the only places a TV ad makes sense vs social media even at $8mn a slot. A few mentions:

- Nike went down the women empowerment message but divided it’s target audience (for me, it was a unoriginal at best),

- AI was presented by Google as your wholesome, “definitely not scary and here for your job”, little helper epitomised by Google Gemini who had as it’s main character a Wisconsin cheesemaker. Their Google Pixel ad gets a 10 for theming. It used a stay at home dad getting help from his AI advisor to highlight his ‘job skills’ for a job interview.

- OpenAI ‘s “What will you create next?” narrative felt like a missed opportunity to showcase some real brand personality. Instead, I think it came off like they were trying to channel the vibe of Apple’s iconic ‘Here’s to the crazy ones’ ad - a very poor imitation if that was the case.

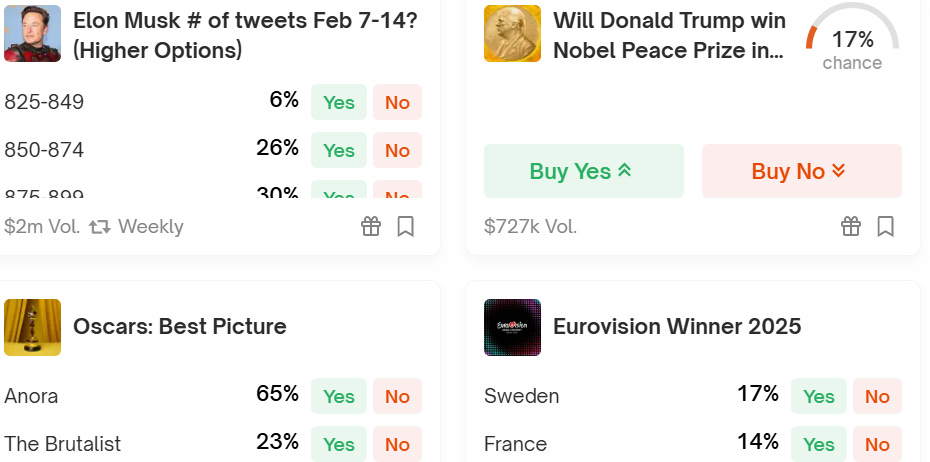

💵 Sports Betting (in fact all betting) is a booming industry made possible by the ability to place a bet from the comfort of our couch using our phone. Polymarket is a new platform which got a lot of attention around the US election (it’s users picked right) and it took $1.1bn in transactions for the Superbowl - 80% of the TOTAL forecast betting volume.

What makes Polymarket different? It’s built on blockchain (the same tech behind cryptocurrency), and this allows it to disrupt the traditional betting models:

- No Losers, Just Fees: Unlike traditional betting platforms that profit from losing bets, Polymarket makes money through transaction fees. Every time users place a prediction, they pay a small fee to use the platform.

- Market-Driven Odds: It operates more like a stock market. Instead of the platform setting the odds, they’re determined by the people making predictions. As more people take positions on an outcome, the odds shift in real time.

- Automated Payouts: Thanks to blockchain, payouts are handled automatically via smart contracts. Once an outcome is decided, funds are distributed instantly—no need to chase down winnings.

Polymarket has already proven its users are good at predicting outcomes, and what’s helping drive its growth is the platform’s ability to engage users in real time. Watching how others are betting and seeing the odds shift dynamically adds a whole new layer of engagement to the experience.

The Rise of Women Sports in Betting

As women's leagues continue to gain visibility and popularity, the demand for betting markets surrounding them is on the rise.

Over 90% of regular men and women bettors expect to watch the same or more women’s sport in the next 12 months

This trend is undoubtedly positive for women's sports, as increased interest drives higher viewership numbers and enhances overall value. While some men's leagues, despite their still-massive audiences, are experiencing declines, advertisers are actively seeking new avenues for growth. Women's sports present a compelling opportunity, and the resulting increase in investment from advertisers leads to greater visibility. This, in turn, generates more interest from bettors, creating a positive reinforcing cycle that benefits the entire ecosystem. Ultimately, this growth opens up more opportunities for women across all aspects of sport, from athletes to executives and beyond.

Another promising area of growth is the rising participation of women bettors. There is a growing recognition of the untapped potential within this demographic. The ability to bet on cultural events, in addition to sporting events, could serve as a gateway to attract more women into the betting market. As a result, I anticipate the emergence of more innovative platforms designed to appeal to these new demographics, further diversifying and expanding the industry.

Polymarket Predictions available 14.02.25

💡 Tech Toy of the Week

🚗 Mevo Car share

What it is: Similar to Lime Scooters, Mevo uses an app to let you use a car to take you where you want to go. You can pick up and park it anywhere within a Mevo zone.

Why it's cool: Australasia's first free-floating and the world's first climate positive car share company, Mevo is tackling the issue of car ownership (NZ, Aus and the US are the top three owners in the world). Not only is too many cars not great for the environment, but they are very costly to own, especially as Mevo claims they are often only used for an average of an hour a day.

Who it's for: Anyone who doesn’t want or need a car full time, but still wants the convenience to go where they want when they when if public transport does not suit. Currently operating in Auckland, Hamilton, Wellington and Nelson.

Price point: From 90c a minute

Standout feature: Planning for autonomous cars in the future. This would be amazing in Nelson for moving kids around to after school sports vs parents doing the moving and causing traffic congestion.

🎧 Up Next

How Cheryl Kellond is building an angel investment portfolio without millions, and you can too!

Brydge Club by Ruffin Mitchener

Why you should listen:

- Cheryl shares her own journey into Angel investing

- You’ll hear about why she started PlayMoney and how it’s designed to get more women investing

- If you’ve heard the phrase ‘Angel Investing’ but don’t really know what it means, you should check this out as part of your ‘investing’ education journey.

Last thought: The role of humans in an AI powered world

I think it's creating magic for humans. Or connecting humans, or showing empathy ….ChatGPT can be pretty empathetic, I'll give it that, but the physical touch, it can’t do it.…..There'll be billions of robot nurses, but the (human) touch of a human nurse is very important… So just think of that. Is it human? Is it a fundamental need of humans? And if so, it probably has a purpose. If it's anything to do with knowledge, it's a zero, literally zero.

Raoul Pal on the Exponentialist (part of the Real Vision platform - free to join)